Follow DIY Superstore on social media to stay updated on the latest specials, products and news

Stay up to date with the latest specials, competitions and promotions.

Steel is a global commodity, and its price varies daily based on a variety of factors. From supply and demand to the strength of the American dollar, seasonality to global pandemics, these factors and more combine to determine the price of steel for manufacturers, buyers, and consumers.

| SOUTH AFRICAN FACTORS |

| The strength of the United States dollar |

| Demand for steel used in any product |

| Trade tariffs |

| GLOBAL FACTORS |

| General condition of the world economy |

| Natural disasters |

| Wars and other political events |

The price of your steel building, in part, is determined by its size and customisation options. Those are internal factors that you can control. But the price of steel, an external factor, also significantly affects the final cost of your steel structures. That’s why we examine the most authoritative sources in the industry to produce our annual forecast. When you’re equipped with the most accurate information on steel pricing, you can determine the best time to lock in your steel building price.

See how steel is finally making a comeback now that lockdowns are ending and businesses are opening.

While expectations were high for steel in 2022, see how those expectations ended up being a bit too optimistic.

The price of U.S. steel has continued to drop since May 2022, bottoming out in November 2022. Even with a late-year increase, prices for steel decreased around 12% in 2022. The sharp drop from May to July was due to a variety of factors, including China’s strict COVID-19 lockdowns, the war in Ukraine and Europe’s related energy crisis, and a decline in demand as inflation and rising interest rates increased the risk of a global recession.

The last two months of the year saw steel prices rebound slightly as China relaxed its COVID-19 restrictions, increasing confidence that the world’s leading steel consumer will experience an uptick in demand in 2023.

According to tradingeconomics.com steel prices bottomed out in April 2020 before recovering in November and December 2020. Prices are expected to continue to increase due to a lack of supply and increasing demand as the United States and China’s economies rebound from the pandemic.

Trading Economics presents the price of steel according to the Chinese currency called Yuan. This is primarily due to the fact that China is the world’s largest producer and typically the biggest consumer of steel. To convert the steel price from the graph, simply use this currency converter to see the exchange rate between Chinese Yuan and American Dollar.

As the world’s leading steel producer and consumer, China and its market have an outsized impact on steel prices around the world. The country’s relaxed COVID-19 restrictions have contributed to optimism in the industry that steel demand and prices could see a substantial increase in 2023. But questions remain whether the relaxed restrictions will be maintained as well as uncertainty around China’s housing market, a leading source of demand.

The World Steel Association, one of the leading industry authorities, shared its most recent Short Range Outlook in October. The revised forecast anticipates a 1% increase in demand and a cautious outlook as the global economy remains volatile due to inflation, war, and COVID-19.

Another industry source, S&P Global, is predicting the current low prices to extend into 2023, but is hesitant to project any long-term decreases. WalletInvestor, an algorithm-based forecast tool, predicts that steel prices will increase 31% over the next year. The varying forecasts and outlooks all point to the volatility of the steel industry and global economy as a whole.

| 2011-2015: China’s market crash leads to stagnant local demand for steel. Thus, China is seen as dumping steel on the global market due to oversupply. As a result, cheap Chinese imports cause the price of steel to plumet along with demand for South African steel exports. Also, imports of Chinese steel into South Africa increases by 6% during this period. Consequently, negatively effecting the suppliers of local South African steel to the domestic market. Economic effect: There is a oversupply of steel in the market pushing down the steel price.  Steel Prices from 2015 to 2017 – Source trading economics |

| Nov 2015: End of commodity boom / commodity super-cycle. Also, South African government impose a 10% tariff on importing steel. Economic effect: Demand for cheap imported steel decreases. The result is an increase in the steel price as the demand for local South African steel increases. |

| 2016: ArcelorMittal South Africa’s largest steel producer is fined R1.5 billion for engaging in collusion by fixing prices and discounts, allocating customers, and sharing commercially sensitive information. Amount to be settled by 2028. Fine in instalments of at least 300 million rand annually over five years starting in 2017. Economic effect: Shareholders sell AM shares due to uncertainty. Thus, Steel prices in South Africa fall due to excessive supply of shares that are now available in the market. |

| May 2017: IDC launches the Downstream Steel Industry Competitiveness Fund. As a result, South African government commit to the allocation of R95 million over 3 years. (2017-2019) |

| March 2018: Section 232 tariffs imposed by the US, placed tariffs of 10% on global steel and aluminium imports. Economic Effect: Demand for South African Steel imports into the US decrease. |

| March 2019: Tropical cyclone veronica causes short term supply disruptions in Australia. As 25 million tonnes of iron ore was not exported a key ingredient used in Steel production. |

| April 2020: Steel production in South Africa reached a record low of 3 Thousand Tonnes in April of 2020 due to covid-19 lockdown. |

| Feb 2020 -Sep 2021: Supply chain bottlenecks start to form as industries open while steel producers underestimate the recovery of the market after lockdown leading to massive shortages. Also, buying patterns change. Instead of going to work or vacation consumers start spending on their homes driving up the demand for steel. Consequently, the surge clogged the supply chain. Causing ships to pile up at harbours, topped off by labour shortages and shipping delays. The combination of scarce supplies and higher demand led to skyrocketing costs through nearly every link of the steel supply chain. |

| Dec 2020: ArcelorMittal restarts second blast furnace will, at the minimum, add around 600 000 tonnes of annual flat steel production in South Africa. |

| Oct 2021 – Nov 2021: Steel prices fall while input costs rocket. Imported coal prices more than doubled – while local steel demand has slumped. The price of steel is falling faster than raw materials. |

| Oct 2021: The three-week strike in the steel and engineering sector and the return of Eskom load shedding for notable periods during the month. |

| Feb 2022: Russia invaded Ukraine. Europe battles to secure steel following Russia’s invasion of Ukraine. Russia and Ukraine produced 5%, or 97 million tons of steel. Both Russia and Ukraine are significant suppliers of steel, iron ore concentrates, iron ore pellets, and coal. |

| May – July 2022: China lockdowns slow down steel production from 96600 tons in May to 81400 in July. Covid-related restrictions caused usage of the commodity in the world’s largest steel-consuming country to fall. |

| April 2022: KwaZulu natal floods cause x damage to infrastructure. Government estimated that it would cost R940 348 500 000 to fix Passenger Rail Agency of South Africa (Prasa) infrastructure. Prasa, which lost about 300km of its rail infrastructure. Estimated total cost of flood damage to approximately R17bn |

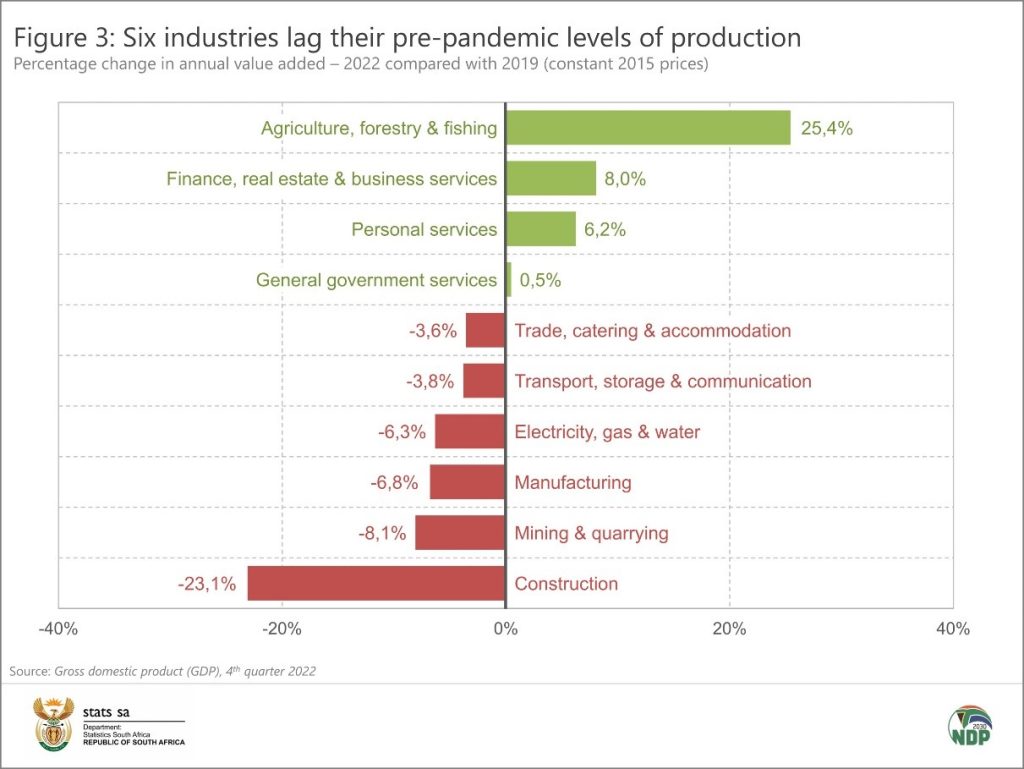

Q4 of 2022: construction is the worst in shape, remaining 23,1% smaller than what it was before the pandemic. Steel Prices South Africa Outlook Steel Prices South Africa Outlook |

| Jan 2023: ArcelorMittal SA, shares plunged more than 15%. It flagged a crash in earnings due to pressure from lower prices, softer demand and coal and transport price hikes. |

| May 2022 – Dec 2022: Europe receives gas from Russia but given the war they are experiencing supply issues. This shot the price of electricity up and as a result the cost of producing steel in Europe. Consequently, Europes steel production fell from 12900 tons in May 2022 to 9200 tons in December 2022. |

| Jan 2023: Due to government policies assist in moving energy prices closer to what it was at the start of the Russian and Ukraine war. Thus production rises to 10 300 tons |

2023: South African construction industry to stabilize at an annual average growth rate of 3% from 2023 |

No matter where you are in the process of building, DIY Superstore has a solution for you. From our detailed building quotes to our growing library of project resources, DIY Superstore is the company you’ve been looking for. We understand the Steel Prices South Africa.

Don’t flush your chance to win down the toilet,

The wordplay on “flush” and “toilet” immediately hints that the answer is toilet-related

Your prize is waiting, so don’t dare spoil it.

“Spoil it” implies things can go wrong — reinforcing the value of a high-quality toilet.

It’s where great thinkers spend their time,

This cheeky line references the common joke that men (and many people) sit on the toilet as part of a daily ritual.

As silence and scrolling clears their mind.

Connects to the modern habit of scrolling phones in private spaces.

It’s your last chance sit upon the throne,

Throne” is a well-known euphemism for a toilet.

A front-flush seat in a class of its own.

This is a direct product clue — the Toilet is specifically a front-flush design.

This bathroom beauty is what you seek

Tells you the location of the product.

A porcelain touch that’s bold and chic.

“Porcelain” confirms material of the product.

PS. each line holds a clue. Use the answer to find the egg hidden in-store to stand a chance to win weekly R1000 vouchers and get one entry towards the grand prize each week.

Cement your chance to WIN R12,329 grand prize,

Wordplay on “cement your chance” — a pun that links directly to cement the product

Lay the foundation — go big, be wise.

“Lay the foundation” refers both to starting a construction project using cement as the base

Mix it up – earn your right to brag,

This hints at the physical process of mixing cement

Then put your entry in the bag.

Mirrors “bag of cement”, keeping the riddle rooted in product-related phrasing.

A brand born local, rock solid and true,

Tells participants this is a South African brand with reliable strength, hinting at CEMZA as the brand of cement

Built for strength — that’s their claim to you.

Plain and direct — emphasises Cemza’s brand promise.

Create Everlasting Monuments, Zone Approved,

The first letter of each word spells CEMZA. It also reinforces the function of cement.

With it in hand, nothing gets moved.

The final line also emphasises the function of cement.

PS. each line holds a clue. Use the answer to find the egg hidden in-store to stand a chance to win weekly R1000 vouchers and get one entry towards the grand prize each week.

Where colour runs deep and the dog knows the way,

Hints directly at Dulux — famous for deep, rich colours and its iconic Dulux dog mascot.

This trusted name brightens homes every day.

Reinforces that it’s a well-known, reliable paint brand

Get ready to do lux with a pearly glow,

A playful wordplay on “Dulux” (“do lux”) and the Pearlglo product

Paint the town — it’s time to put on a show.

Refers to painting (the product’s purpose)

Put nose to the ground its time to explore,

This reinforces the subtle Dulux dog imagery.

Find glow that’s hidden on the see floor.

This line leads to Dulux PearlGlo paint by evoking the imagery of pearls (treasures) that glow on the seafloor

Like a smile with charm, it’s got good enamel,

This hints at Pearlglo an enamel paint without directly naming the paint type.

Smooth, tough, and tidy — no mess to unravel.

Describes the key qualities of Dulux Pearlglo

PS. each line holds a clue. Use the answer to find the egg hidden in-store to stand a chance to win weekly R1000 vouchers and get one entry towards the grand prize each week.

When the leaves start to fall, orange becomes the new pink,

References the iconic orange of the Incgo brand

Get ready — the power’s in your hands, all you have to do is think.

Suggests the tool is handheld and powerful, hinting at a portable power tool

So don’t let the Inc dry before you go,

A clever wordplay: “Inc” and “go” sounds like Ingco, the brand.

If you’re not plugged in, you will feel the blow.

“Blow” refers to the blower function of the power tool

Charge your batteries — you’re about to up your game,

This reinforces the cordless design — the tool runs on rechargeable batteries

Don’t leaf a clue behind, your ego won’t be the same.

Pun intended: “Leaf” = leaf blower

May the invisible force be with you,

This references airflow — the powerful, unseen blast created by a blower.

As you wield your tools to uncover the clues.

PS. each line holds a clue. Use the answer to find the egg hidden in-store to stand a chance to win weekly R1000 vouchers and get one entry towards the grand prize each week.